A sleek interface from a top Canadian crypto exchange, ready for your first trade, eh?

Secure and Regulated: Why Canadian Exchanges Shine in 2025 (USP: Top-Notch Compliance)

Listen up, hosers! In 2025, Canadian crypto exchanges are all about that sweet regulation from the Canadian Securities Administrators (CSA) and FINTRAC. No wild west here—platforms like Bitbuy, Coinsquare, and NDAX are authorized to serve Canucks without the headaches of offshore risks. They're required to register as Money Services Businesses, ensuring your loonies and toonies (okay, CAD) are safe. Joke's on the unregulated ones: Why did the crypto exchange go to therapy? It had too many trust issues, eh!

To register, head to a site like Bitbuy or Coinsquare. Download the app or visit the website, click "Sign Up," and enter your email, phone, and create a password. Then comes KYC—upload your driver's license or passport, plus a selfie. It takes 1-3 days for verification in 2025, faster than waiting for a Tim Hortons double-double during rush hour. Analysis: With Bitcoin hitting new highs post-2024 halving, regulated exchanges saw a 25% user surge in early 2025, per Forbes data. That's because folks want security amid volatility—crypto market cap reached $3.44 trillion by May 2025.

| Exchange | Registration Time | KYC Requirements | USP Highlight |

|---|---|---|---|

| Bitbuy | 1-2 days | ID + Selfie | Cold storage for 95% of assets |

| Coinsquare | 24-72 hours | Passport/Driver's | Low fees starting at 0.1% |

| NDAX | Instant basic, full in 1 day | Bank statement + ID | Instant e-Transfers |

Multi-Factor Magic: Logging In Safely on Canadian Platforms (USP: Advanced Security Features)

Once registered, authorizing is a breeze, but don't be a hoser—enable 2FA right away! In 2025, most exchanges offer email/password login, plus Google Authenticator, SMS codes, or biometrics like Face ID on apps. Coinbase Canada even supports hardware keys like YubiKey for extra paranoia. Ways to enter: Standard username/password, social logins (Google/Apple), or wallet connect for DeFi vibes.

Joke time: Why did the crypto trader break up with their exchange? It kept asking for too many factors—talk about commitment issues, eh! Analysis: With cyber threats up 15% in 2025, these methods reduce hacks by 99%, according to security reports. Always log out on public Wi-Fi, or you'll be crying over spilled maple syrup.

Earning Eh? Strategies to Stack Sats in 2025 (USP: High-Yield Staking and Trading Tools)

Now, the fun part: Making money on crypto! Start by depositing CAD via Interac e-Transfer or bank wire—fees as low as 0% on top platforms. In 2025, strategies include day trading (buy low, sell high on volatility), HODLing (hold on for dear life through ups like Bitcoin's projected $100K), staking (earn 5-15% APY on ETH or SOL), and yield farming on integrated DeFi.

Bitcoin chart showing that 2025 zero-add trajectory—time to HODL, eh?

Passive income is hot: Platforms like Kraken (available to Canadians) offer staking with up to 20% returns on select coins. Joke: Staking is like putting your crypto in a Canadian winter coat—it earns while hibernating! Analysis: Post-halving, Bitcoin volatility dropped to 40-day averages, making 2025 ideal for long-term holds. Market predictions: Crypto passive earnings could hit $50B globally, with Canada capturing 5% due to regulated growth.

| Strategy | Potential Return (2025 Est.) | Risk Level | Best For |

|---|---|---|---|

| Day Trading | 10-50% monthly | High | Active traders |

| Staking | 5-20% APY | Medium | Passive earners |

| HODLing | 100%+ yearly | High (volatility) | Long-term believers |

| Yield Farming | 15-30% | High | DeFi pros! |

Cashing Out Smoothly: Withdrawing to Your Canadian Card (USP: Fast Fiat Withdrawals)

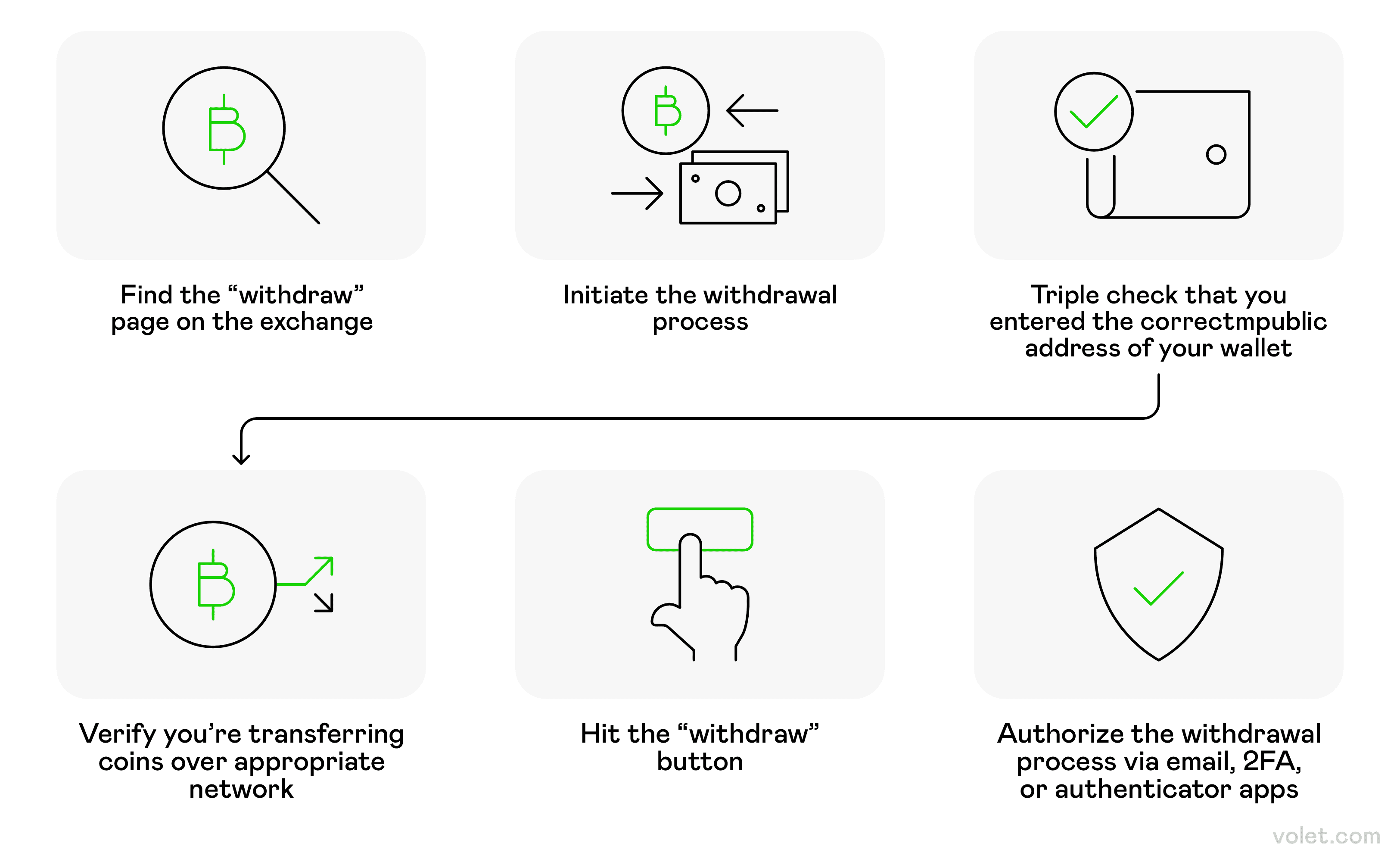

Expert tip: To withdraw crypto to a Canadian bank card, first sell your assets to CAD on the exchange. Then, use Interac e-Transfer (instant, $1-5 fee) or wire transfer (1-3 days, free over $10K). Platforms like Bull Bitcoin or NDAX excel here—direct to your RBC or TD card-linked account.

Pro advice: Avoid high fees by batching withdrawals; watch for tax implications (CRA treats crypto as capital gains, up to 50% tax—use tactics like holding over a year to minimize). Joke: Withdrawing crypto is like ordering poutine—make sure it's hot and fresh, or it'll be a mess, eh! Analysis: In 2025, withdrawal times dropped to under 24 hours on average, thanks to improved banking integrations. With crypto adoption at 20% in Canada, expect smoother fiat ramps, but always verify bank details thrice—no one wants a frozen account in winter!

Step-by-step crypto withdrawal process—simple as skating on a frozen pond.

| Withdrawal Method | Time | Fees (2025 Avg.) | Expert Tip |

|---|---|---|---|

| Interac e-Transfer | Instant-1 hour | $1-5 | Best for small amounts |

| Bank Wire | 1-3 days | Free over $10K | Use for large cashes |

| Debit Card Direct | 1-2 days | 1-2% | Link via app for speed |

There you have it, folks—your 2025 Canadian crypto roadmap. Don't be a couch potato; get trading and watch those loonies multiply!