Where Crypto Meets the Maple Leaf: A Visual Guide to Canadian Crypto Hotspots

Ah, Canada – land of poutine, hockey, and now, some serious crypto action, eh? If you're looking to turn your loonies into crypto fortunes in 2025, you've come to the right igloo. With Bitcoin miners earning about $20 million a day globally and Canadian ETFs booming, the scene up here is hotter than a Tim Hortons double-double. But remember, crypto ain't legal tender – it's more like a risky beaver tail treat. We'll break down strategies, toss in expert tips, and crunch 2025 numbers. Let's get aboot it!

Unique Trading Point: Day Trading – Ride the Waves Like a Pro Surfer on Lake Ontario

Day trading crypto in Canada? It's like playing pond hockey – fast, exciting, but you might end up on your keister if you're not careful. In 2025, platforms like Kraken and Coinbase are top picks for low fees and compliance with CRA rules. Analysis shows Bitcoin's daily volatility hitting 2-5%, perfect for scalping small gains. But here's the joke: Why did the Canadian trader cross the road? To get to the other side of the pump and dump! Expert rec: Use Dollar-Cost Averaging (DCA) to buy dips – invest $100 weekly in BTC or ETH. Analytics for 2025: With hash rates surging post-halving, expect 7-15% monthly returns if you nail trends, but taxes hit 50% on capital gains. Pro tip: Stick to regulated exchanges to avoid getting hosed by scams.

Crypto Trading Charts Waving the Canadian Flag – Spot Those Trends!

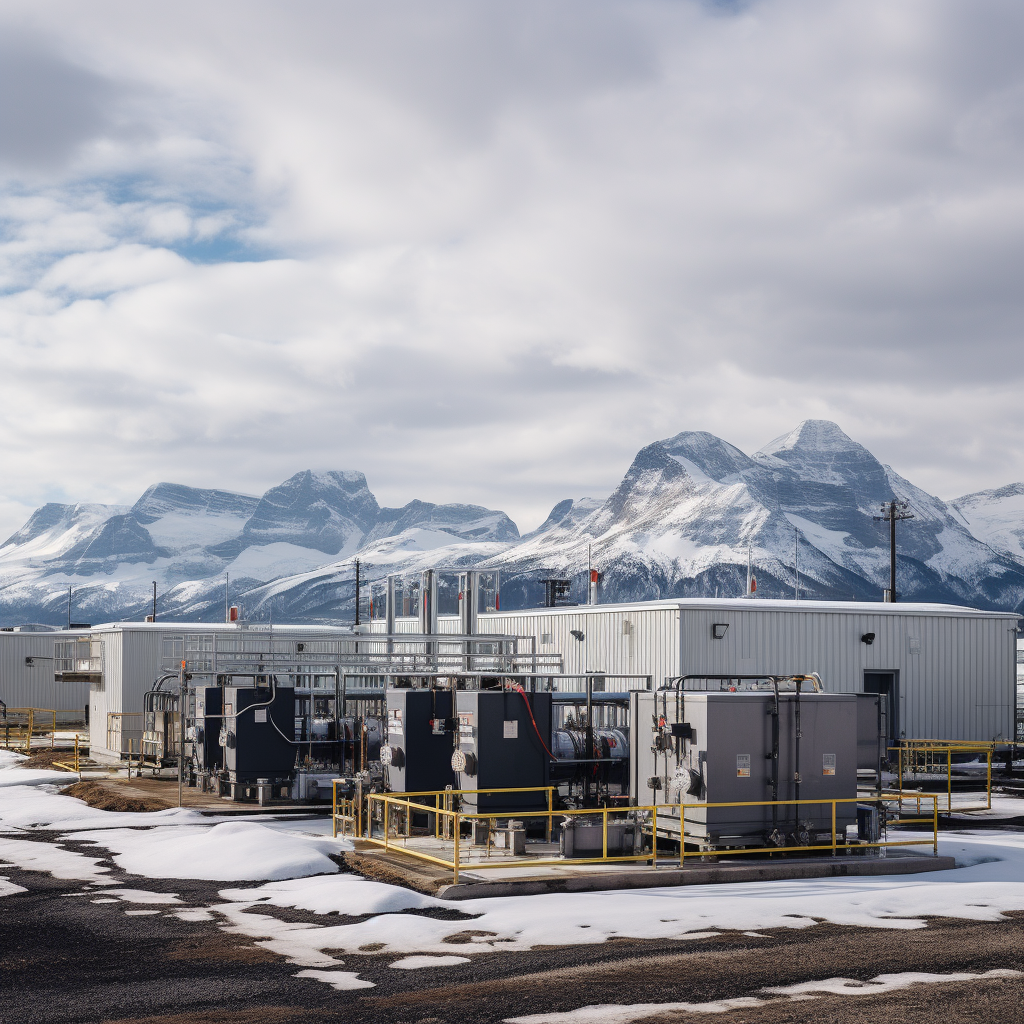

Unique Trading Point: Mining – Dig Deep Like a Prairie Farmer in Alberta

Mining in Canada? With cheap hydro power in Quebec and B.C., it's profitable as all get-out in 2025. Hut 8 and SOL Strategies are killing it, with stocks up 250%+ YTD. Analysis: Electricity costs average $0.05/kWh in hydro-rich spots, making home rigs viable – a single ASIC miner could net $5-10/day post-halving. But cloud mining's booming too, with platforms like DeepHash offering free BTC rewards for newbies. Joke: Why don't Canadian miners play hide and seek? Because good luck hiding when your rig's louder than a Zamboni! Expert rec: Go green with hydro setups to dodge carbon taxes. 2025 analytics: Global revenue projections top $110 billion, but CRA treats mining as business income – fully taxable. Start small, eh?

Bitcoin Mining Rigs Braving the Canadian Snow – Cold Outside, Hot Profits Inside!

Unique Trading Point: Staking & DeFi – Let Your Coins Work While You Sip Maple Syrup

Staking's the lazy Canadian's dream – lock up your ETH or SOL and earn rewards without breaking a sweat. In 2025, platforms like Lido and Aave offer 5-12% APY on DeFi staking. Analysis: With CRA viewing staking as income (fully taxed), but only 50% on gains, it's a sweet spot. Yield farming on Uniswap could boost that to 20%+, but watch for impermanent loss. Joke: Staking's like Canadian winter – lock in and wait for the thaw to cash out! Expert rec: Diversify with Canadian-friendly wallets like Ledger; avoid over-leveraging in DeFi to prevent liquidations. 2025 analytics: DeFi TVL hits $200B globally, with Canadians flocking to safe plays post-CARF regs.

Staking Rewards Growing Like a Hockey Stick Graph – Passive Income, Eh?

Unique Trading Point: ETFs & Long-Term Holding – The Timbit-Sized Entry for Newbies

Don't wanna trade? Grab a Canadian crypto ETF like Purpose Bitcoin or CI Galaxy – 15 options in 2025, tracking BTC, ETH, even Solana. Analysis: Easier than mining, with exposure without holding keys. Long-term holding (HODL) shines with BTC up 150% YTD. Joke: Holding crypto's like waiting for the Leafs to win the Cup – patience pays off, eventually! Expert rec: Buy the dip via Wealthsimple or NDAX; use tax-loss harvesting to offset gains. 2025 analytics: ETFs manage $10B+ in assets, with min investments as low as a toonie.

Strategy Comparison Table: Which One's Your Puck?

| Strategy | Risk Level | Potential 2025 Returns | Startup Cost | Tax Treatment | Best For |

|---|---|---|---|---|---|

| Day Trading | High (like skating on thin ice) | 10-50% monthly | Low ($500+) | 50% capital gains | Active hosers who love charts |

| Mining | Medium-High | $5-20/day per rig | Medium ($2K+ for hardware) | Business income (100%) | Tech-savvy folks in hydro provinces |

| Staking/DeFi | Medium | 5-20% APY | Low ($100+) | Income (100%) on rewards | Passive earners sipping Timmies |

| ETFs/HODL | Low | 50-200% yearly (based on market) | Very Low ($50+) | 50% capital gains | Beginners avoiding the crypto wilds |

Expert Wrap-Up: 2025 Analytics & Final Tips

In 2025, Canada's crypto scene's regulated but rewarding – new CARF rules mean exchanges report everything to CRA starting 2026, so track your trades like a Mountie on patrol. Analytics show mining profitability up 35% with next-gen ASICs, while DeFi passive income dominates for low-effort gains. My top rec: Diversify – 40% in ETFs, 30% staking, 20% trading, 10% mining. And sorry aboot the risks, but only invest what you can afford to lose. Stay frosty, Canada!