A typical crypto exchange registration screen for Canadians – easy as pie, eh?

Secure and Compliant: Top Exchanges for Easy Registration in Canada 2025

Hey there, fellow Canuck! If you're looking to dip your toes into the crypto pond without freezing your assets off, registering on a Canadian-friendly exchange is your first step. In 2025, with regulations tighter than a touque in winter, stick to authorized platforms like Bitbuy, Coinbase Canada, Coinsquare, Crypto.com, and Kraken – all registered with the Canadian Investment Regulatory Organization (CIRO) or provincial securities bodies. These bad boys offer seamless sign-ups, eh?

Here's the drill: Head to their app or site, punch in your email, create a password stronger than maple syrup, and verify with a phone number. Then comes KYC – upload your ID (like a driver's license or passport) and maybe a selfie. Don't be a hoser and skip this; it's to keep things legit and protect your loonies. Most approve in 24-48 hours, faster than waiting for the Timmy's drive-thru.

Pro tip: Start with Bitbuy or Shakepay for beginners – they're as user-friendly as a game of shinny. Forbes ranks Kraken and Crypto.com high for security and low fees in 2025. Joke's on you if you forget 2FA – that's like leaving your igloo unlocked!

| Exchange | Registration Time | Fees for Sign-Up | Unique Perk (USP) |

|---|---|---|---|

| Bitbuy | 1-2 days | Free | Canadian-owned, instant e-Transfers |

| Coinbase Canada | Under 24 hours | Free | Beginner tutorials, insured funds |

| Kraken | 1-3 days | Free | Advanced charting, high staking yields |

| Crypto.com | Instant verification | Free | Debit card for spending crypto |

| Coinsquare | 1 day | Free | Low spreads on CAD pairs |

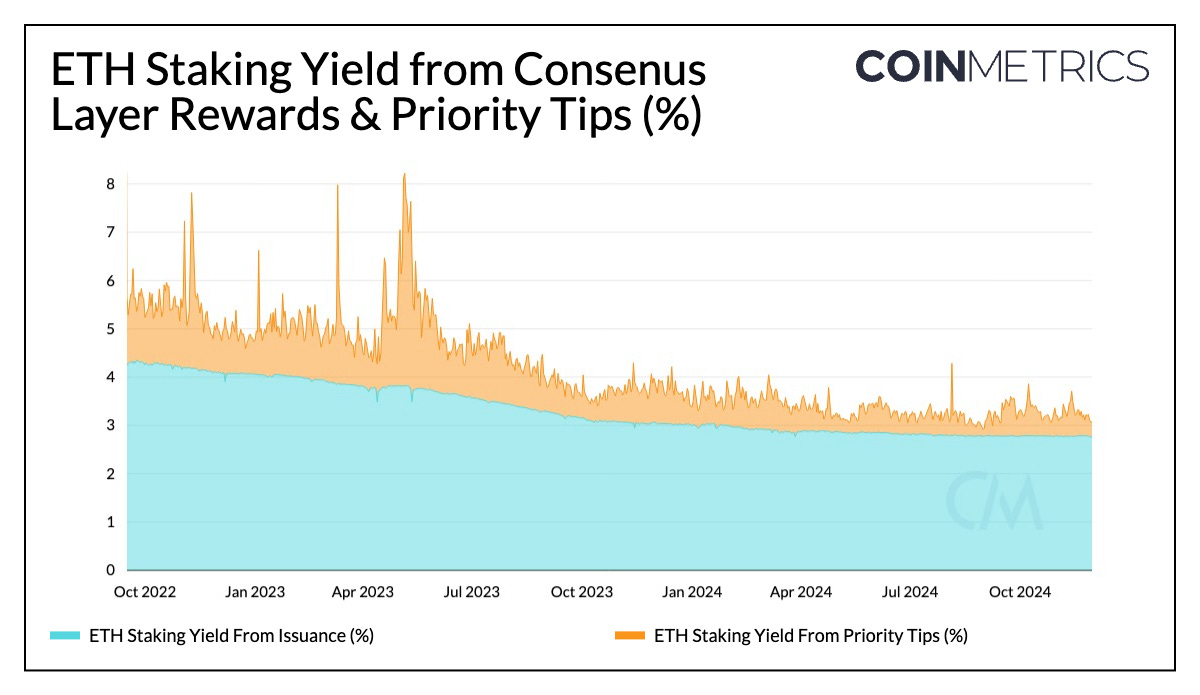

Staking rewards chart – watch your crypto grow like a beaver dam!

Passive Earnings Powerhouse: Stake and Lend for Hands-Off Gains in 2025

Once you're in, why not let your crypto work harder than a Mountie on duty? Passive income in Canada 2025 means staking and lending – no day trading required, eh? Staking locks up your coins to secure the network, earning rewards like ETH at 4-5% APY or SOL up to 7% on platforms like Bitbuy (up to 12.77% on select coins) or Kraken (up to 21% on assets like DOT). Coinbase offers up to 15% via DeFi lending.

For lending, try Ledn – a Toronto-based gem offering 7.5% on USDC and 5.25% on BTC, perfect for stable passive vibes. Or Uphold for auto-earn on idle assets. USP here? These are regulated in Canada, so no sketchy offshore risks. Start small: Buy ETH or ADA, stake via the app, and watch rewards compound. But sorry, not sorry – taxes apply on earnings as income, per CRA rules.

Analytics scoop: In 2025, staking is booming with Ether outperforming Bitcoin in Q3, and institutional adoption spiking. Canadian crypto ETFs like 3iQ Solana Staking ETF make it even easier for passive plays. Expect yields to dip slightly with more stakers, but still beat GICs at 3-4%.

| Coin | Platform | APY in 2025 | Lock-Up Period | USP |

|---|---|---|---|---|

| ETH | Kraken | 4-7% | Flexible | Auto-earn feature |

| SOL | Bitbuy | 6-8% | 7-28 days | High rewards for Canadians |

| USDC | Ledn | 7.5% | None | Stablecoin safety net |

| DOT | Coinbase | 14%+ | Varies | DeFi integration |

| ADA | Uphold | 3-5% | Flexible | Easy unstaking |

Funny bit: Staking's like putting your crypto on a Zamboni – it smooths out the ride while earning you toonies!

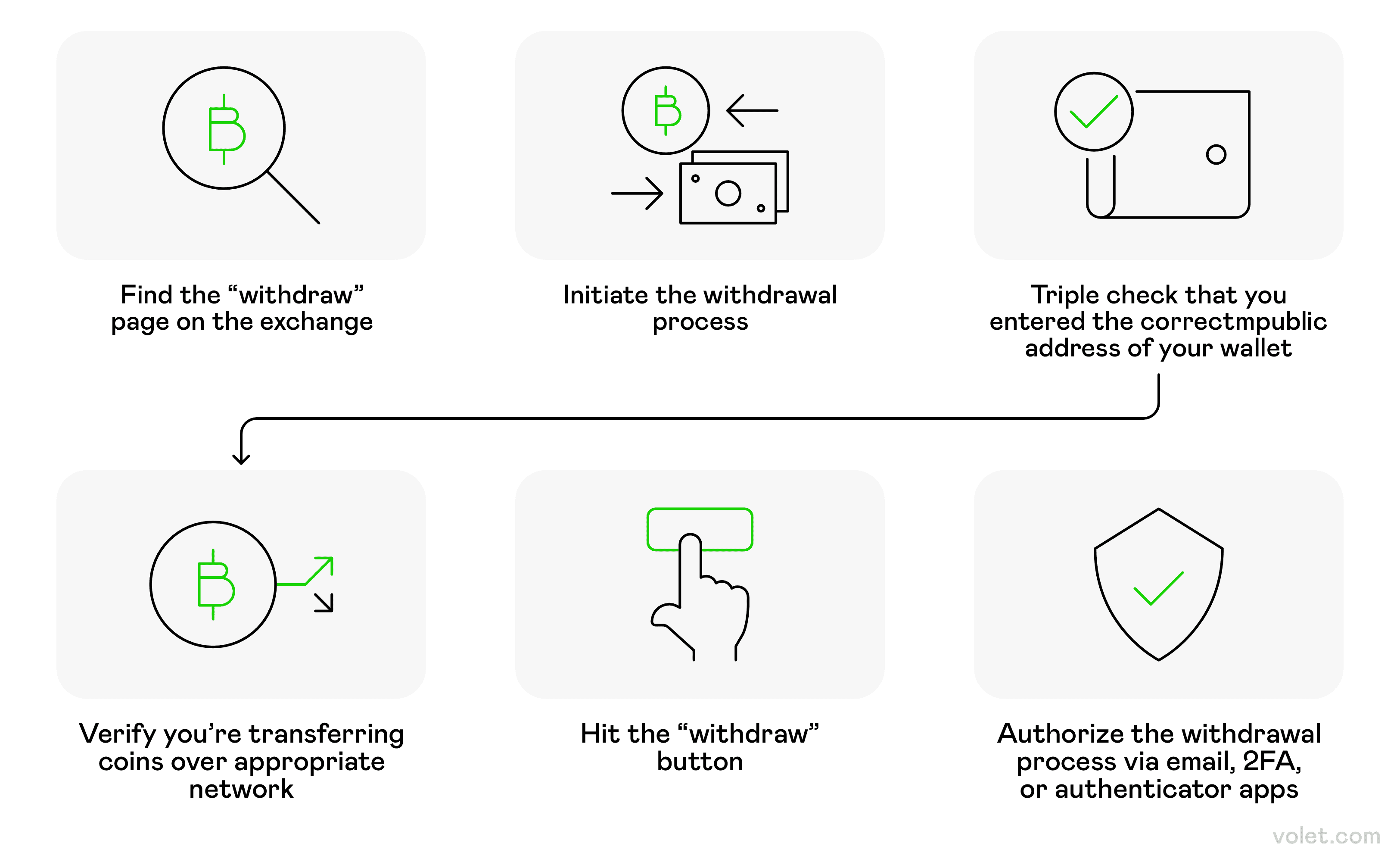

Illustration of withdrawing crypto to your Canadian bank card – smooth as butter tarts.

Expert-Approved Withdrawals: Cash Out Crypto to Your Canadian Card Without the Hassle

Alright, you've stacked those sats – now how to turn 'em into loonies for that double-double? In 2025, withdrawing to a Canadian bank card is straightforward on compliant exchanges. Sell your crypto to CAD, then use Interac e-Transfer (instant, under $10k) or wire transfer (for bigger bucks, 1-3 days). Platforms like NDAX or Shakepay shine here with free or low-fee e-Transfers.

Expert tips: Always double-check addresses – one wrong digit and poof, your funds are gone faster than a puck in overtime. Use 2FA, and withdraw in batches to minimize fees (0.5-2% typically). For cards, link your Visa/Mastercard via the app for direct top-ups on Crypto.com. Watch for taxes: Gains are capital, but CRA's watching like a hawk.

USP edge: Coinbase and Kraken offer insured withdrawals, and Bitbuy's same-day CAD outs are a game-changer. If you're in a pinch, Bitcoin ATMs work but with higher fees – not ideal, eh?

| Method | Time | Fees | Best For | USP |

|---|---|---|---|---|

| Interac e-Transfer | Instant-1 hour | $0-5 | Small amounts | Quick CAD to bank |

| Wire Transfer | 1-3 days | $10-30 | Large sums | Secure for high rollers |

| Debit Card Top-Up | Instant | 1-3% | Everyday spending | Spend crypto directly |

| P2P (e.g., LocalBitcoins) | Varies | Low | Privacy | Peer-to-peer trust |

| ATM | Immediate | 5-10% | Cash needs | Anonymous but pricey |

Joke alert: Withdrawing crypto's like getting change from a toonie – make sure you don't lose the loonie in the process!

Crypto market trends graph for 2025 – riding the wave, Canucks!

2025 Market Analytics: Why Now's the Time to Jump In, Eh?

Wrapping up with some brain food: Canada's crypto market is set to grow at 18.6% CAGR through 2030, hitting billions in value. Bitcoin could smash $100k-$250k by year-end, per experts like Tom Lee, fueled by halving effects and ETF inflows. Ethereum's leading with DeFi growth, and altcoins like SOL are hot for staking.

But volatility's real – Q3 2025 saw ETH outpace BTC, yet dips are possible. USP for Canadians? Regulated platforms mean safer plays amid global uncertainty. Prediction: Passive strategies will shine as institutions pour in, making 2025 a bull run bonanza. Don't sleep on it – or you'll be sorry like missing the last donut!