Hey there, fellow Canuck! If you're looking to dip your toes into the crypto pond without freezing your assets off like a polar dip in January, you've come to the right place. In 2025, the crypto scene in Canada is hotter than a Tim Hortons double-double, with regulated exchanges making it safe and simple. We'll walk you through registering on a top-notch platform, kicking off some passive income (because who doesn't love money working harder than you, eh?), and cashing out to your loonie-loving bank card. Plus, some expert tips and fresh analytics to keep you ahead of the curve. Don't be a hoser – let's turn those digital coins into real toonies!

Secure and Compliant Platforms: Picking the Best Crypto Exchange in Canada

First things first: Canada ain't the Wild West for crypto anymore. Thanks to regulators like the OSC and FINTRAC, exchanges must be registered to operate legally. In 2025, top picks include Bitbuy, NDAX, Shakepay, and Kraken – all compliant and user-friendly for beginners. Why these? Low fees, strong security, and easy CAD integration. No more sketchy offshore deals that could leave you high and dry like a beaver dam in drought.

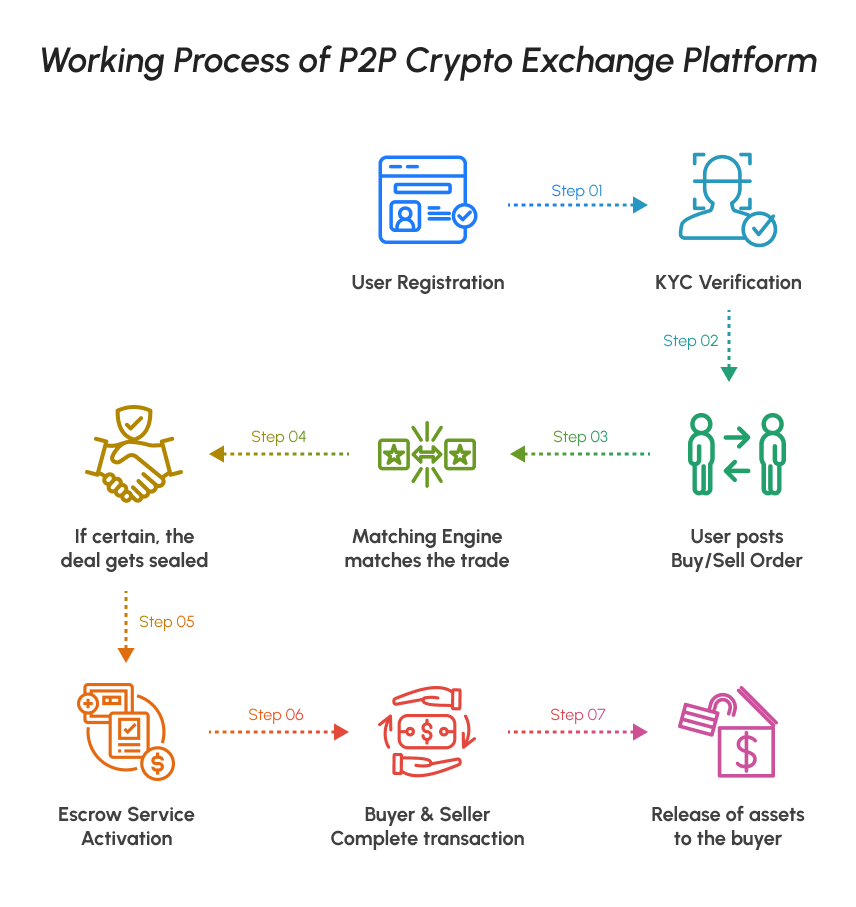

P2P Crypto Exchange Registration Flowchart – Your Roadmap to Getting Started

Here's how to register, step by step (using Bitbuy as an example, but it's similar across the board):

- Head to the exchange's website or app (bitbuy.ca for this one).

- Click "Sign Up" and enter your email, create a password.

- Verify your identity with KYC – upload your driver's license or passport, plus a selfie. This is mandatory in Canada to keep things legit.

- Link your bank account for CAD deposits via e-Transfer or wire.

- Fund your account – start small, like $50 CAD, to test the waters.

- Boom! You're in. Expect approval in 24-48 hours, faster than waiting for the Zamboni at a hockey rink.

Pro tip: Choose exchanges with IIROC registration for extra peace of mind. And hey, if you're in Quebec, double-check provincial rules – they're stricter than a ref in overtime.

Low-Risk High-Reward Options: Starting Passive Earnings on Crypto Platforms

Now that you're registered, let's make your crypto hustle for you. Passive income in crypto is like having a Zamboni that cleans the ice while you sip your Timmy's – minimal effort, steady rewards. In 2025, Canadians are loving staking, lending, and yield farming, with platforms like Kraken and Crypto.com offering up to 10-15% APY on select coins. No day trading required; just lock in and watch the gains roll in.

Staking for Passive Income: Lock In and Earn Like a Pro

Key strategies for 2025:

- Staking: Lock your ETH or SOL on exchanges like Coinbase Canada or Kraken. Earn 4-8% annually by helping secure the network. It's eco-friendly compared to mining – no need for a power-hungry rig that spikes your hydro bill.

- Lending: Platforms like Bitbuy or DeFi apps (via wallets) let you lend crypto for interest. Rates hit 5-12%, but stick to regulated ones to avoid rug pulls.

- Yield Farming: For the adventurous, use liquidity pools on Uniswap (accessible via Canadian wallets). Higher rewards, but watch for impermanent loss – it's riskier than a moose crossing the Trans-Canada.

| Strategy | Avg. APY in 2025 | Risk Level | Best Platforms for Canadians | USP |

|---|---|---|---|---|

| Staking | 4-8% | Low | Kraken, Gemini | Secure, no active trading needed – set it and forget it, eh? |

| Lending | 5-12% | Medium | Bitbuy, Crypto.com | Earn on stablecoins like USDC for steady loonies without volatility. |

| Yield Farming | 10-20%+ | High | DeFi via MetaMask (linked to exchanges) | High rewards for providing liquidity – like farming, but with crypto instead of maple syrup. |

Joke time: Why did the Canadian crypto investor stake his coins? Because he wanted to "eh-rn" passive income without breaking a sweat!

Fast and Fee-Friendly Methods: Withdrawing Crypto to Your Canadian Card

You've earned it – now cash it out without getting hosed on fees. In 2025, most exchanges support direct withdrawals to Canadian bank cards or accounts via Interac e-Transfer, which is instant and cheap (under $1). Expert tip: Sell your crypto to CAD first, then withdraw. Avoid direct crypto-to-card if possible – it's pricier due to conversion fees.

Withdrawing from Crypto.com: Fiat Wallet to Bank – Quick and Easy

Steps to withdraw (using Shakepay or NDAX):

- Sell your crypto for CAD in the app.

- Go to "Withdraw" and select e-Transfer or bank wire.

- Enter your bank details – RBC, TD, or Scotia work great.

- Confirm and wait 0-5 business days (e-Transfer is often same-day).

- Fees? Around 1-2% max, way better than ATM gouging.

Expert advice: Use Bull Bitcoin for BTC-specific withdrawals – they specialize in fast CAD transfers. Watch for tax implications; the CRA treats crypto sales as capital gains, so track everything like a beaver building a dam. And if fees bug you, batch withdrawals to save loonies.

2025 Crypto Analytics: Trends and Projections for Canada

Diving into the numbers: The Canadian crypto market is projected to hit US$1.3 billion in revenue by year's end, with annual growth of 15-20%. Ether's outperforming Bitcoin, thanks to institutional adoption and spot ETFs like Fidelity Advantage Bitcoin ETF (FBTC). APAC's leading global growth, but Canada's not far behind with tokenized assets and AI-driven trading on the rise.

| Trend | 2025 Projection | Impact on Canadians |

|---|---|---|

| Institutional Adoption | Up 30% | More stable prices, easier passive earning via ETFs like CI Galaxy Bitcoin. |

| Regulatory Tightening | New CBDC pilots | Safer exchanges, but higher KYC – no more anonymous hodling. |

| DeFi Growth | 25% market share | Better yields, but stick to compliant platforms to avoid fines. |

| AI & Cloud Mining | Emerging passive tools | Passive income via bots, with returns up to 10% on low-risk setups. |

Bottom line: 2025's bullish for passive crypto in Canada, but diversify like a true north portfolio – mix staking with ETFs. If the market dips, remember: It's just a blip, eh? Stay frosty and keep earning!